Published on July 15, 2024

Table of Contents

As fintechs transform the banking industry with cutting-edge customer and digital experiences, they’re faced with a growing challenge: how to balance mounting regulatory scrutiny with rapid innovation. FDIC’s recent action against First Fed Bank (read more) is just one example of the growing pressure fintechs face to balance innovation, security, scale, and compliance. As fintechs race to deliver new features and enhance digital offerings, they must adopt new strategies. Service mesh offers a path to addressing observability, zero-trust, and scale challenges while meeting stringent compliance requirements, so fintechs can focus on responsible and scalable innovation.

Compliance demands a new approach

Meeting regulatory demands presents a daunting task for any company, but especially for fintechs, who must do so without sacrificing speed of innovation or scale to survive. Traditional tools aren’t well-suited for the task at hand - they just weren’t designed for highly-dynamic, ephemeral environments. They’re typically deployed and managed through centralized infrastructure, require point and click UI operations to make changes, and aren’t aligned with GitOps or infrastructure automation practices. In order to meet compliance demands and security standards without inhibiting innovation or limiting scale, fintechs must take a new approach.

Start with observability

Observability is key to monitoring customer transactions using KYC and AML systems. The greatest risk within fintech organizations is an inconsistent implementation of end-to-end observability across platforms, facilitated by API’s. Fundamentally, you can’t control, secure, or protect what you can’t see.

As such, regulators require fintechs to maintain an audit trail of API authentication, authorization, quota management, observability, and overall health so that if there’s an incident, they’re able to track exactly when, why, and how it happened. Ask any platform engineer - this is required for good reason, but has historically been extremely difficult to achieve. A service mesh (like Gloo Mesh), gives teams unparalleled visibility into what was previously a black hole of microservices. Rich, fine-grained observability for all service-to-service communication between microservices, using OpenTelemetry as a standard method for collecting telemetry data (metrics, logs and traces) across systems, is now within reach for the first time.

Zero Trust Security at Scale

As fintechs continue to build and scale dynamic, cloud-native networks, communication between services often happens over the internet, further increasing both the size of the threat vector and vulnerability to cybersecurity attacks. Let’s unpack the zero trust challenges of modern application networks, and why it matters to fintechs more than most.

- The “trusted zone” no longer exists, and the entire network must be assumed adversarial. Just talking about zero trust is no longer enough - it’s imperative. For fintechs, advanced API integrations enable banks to provide customers with account access, payments, and financial data sharing through multiple channels. These transactions require the deepest level of scrutiny possible as initiating these transaction workflows turn into real customer money movement and data visibility for the most sensitive information.

- With dynamic instances of applications and services, IP is no longer an adequate unit of control. The universal way of achieving the “zero trust” model for microservices networking is using mutual TLS (mTLS), but Fintechs have historically struggled to roll this capability out at scale. Service mesh technologies like Gloo Mesh simplify standardization of mTLS encryption for secure communication between services, as well as fine-grained access control through role-based access control (RBAC) policies.

- FinTechs also face threats like DDoS attacks. Gloo Mesh also enables policy enforcement for authentication, authorization, and rate limiting, helping to protect against threats like unauthorized access, data breaches, and denial-of-service attacks. This use case is vital for ensuring the confidentiality, integrity, and availability of microservices and sensitive data.

Strong zero trust network controls enable Fintech organizations to correspond to critical compliance and regulatory standards. Implementing a zero-trust architecture for network control ensures that no data access is granted without appropriate authentication and authorization.

Securing Application Traffic with Istio - is OSS the silver bullet?

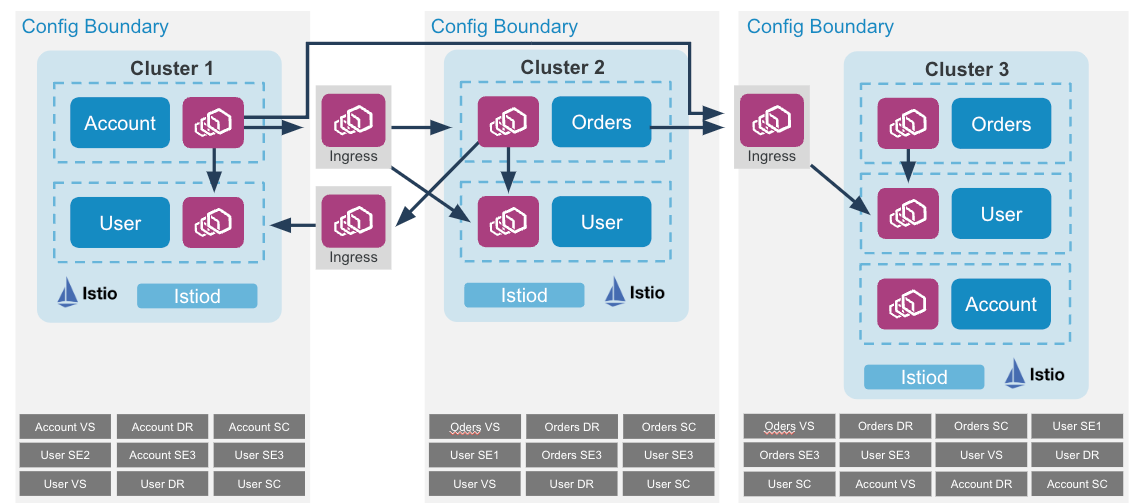

Often platform teams who want to address observability and zero trust concerns will start with an OSS service mesh like Istio. Istio, in particular, offers powerful capabilities backed by a large, thriving community with very strong adoption in the Fintech space. However, teams quickly begin to struggle with operational complexity and management at scale. The open source project comes with maintainability concerns that demand significant investments from already stretched platform teams. The diagram below illustrates the configuration sprawl that Platform Engineering teams face.

Managing service mesh configuration at scale across multi-everything (clusters, regions, cloud providers) is hard. Teams begin to struggle with maintaining consistent configuration for each mesh, often labeled configuration sprawl. Also, Platform Engineering teams are generally lean and need resources that ease the operational burden that comes with multi-cluster management. That’s where Gloo Mesh can help:

- Gloo Mesh Enterprise simplifies tackling configuration sprawl and managing Istio at scale with a single management plane for configuration, segmentation, and observability.

- Through the Gloo Mesh management control plane, application networking can be managed at a global scale, while at the same time enabling fine-grained control over failover, multi-region routing, and inter-mesh communication

- Gloo Mesh Enterprise enables Platform Engineering teams to deliver multi-everything observability for complex applications using the Gloo telemetry pipeline architecture.

Where to get started

SuperOrbital helps fintechs accelerate service mesh adoption by providing expert guidance along every step of the implementation, leading to successful deployments of these patterns for even very lean platform engineering teams. Through an education-driven approach, fintechs build a strong understanding of the solutions that they choose to put in place with a solid foundation built alongside experienced engineers. That foundation enables fintechs to maintain a system for the long run - one that provides the necessary security, availability, reliability, and performance capabilities to meet rigorous compliance demands.

Kubernetes at scale for Fintechs

The SuperOrbital team has also developed and delivered best-in-class training for companies using Kubernetes at a significant scale. Through hands-on, real-world experiences, Fintech teams can become comfortable with the required steps to deliver highly reliable applications within the Kubernetes ecosystem. Intensive discussion with experienced instructors enables your engineers to build a stronger context and understanding for their own implementation of these mission-critical solutions.

Conclusion

Gloo Mesh, coupled with a world-leading professional services team from SuperOrbital, unlocks the ability to scale without sacrificing security, resiliency, or observability. This ultimately ensures organizations have the observability, zero trust security posture, and end-to-end secure application traffic needed to maintain compliance, meet regulatory constraints, prevent cybersecurity incidents, and scale to meet the growing customer demand for Fintech organizations.